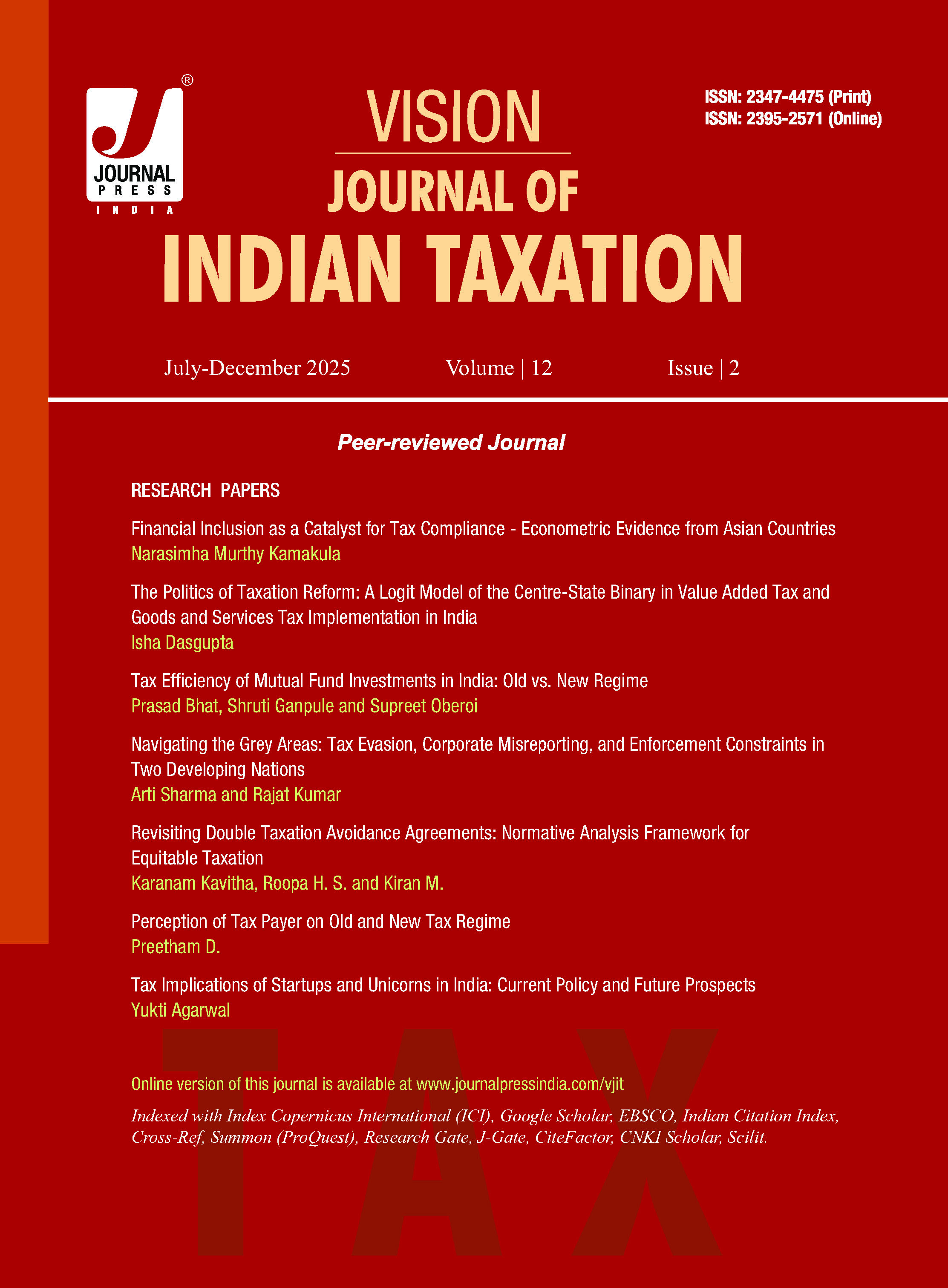

VISION: Journal of Indian Taxation

Double-blind Peer-reviewed (Refereed) Journal: No publication charges

Published By: Journal Press India

Print ISSN: 2347-4475;e-ISSN: 2395-2571

Editor/s: Dr. Sameer Lama

Frequency: Bi-annual

Indexation: Index Copernicus International, Google Scholar, EBSCO, Summon (ProQuest), Indian Citation Index, Cross-Ref, CNKI Scholar, Research Gate, J-Gate and Scilit.

Important Information for authors

It has been brought to our notice that some third parties are fraudulently charging Fees from authors for submission of manuscripts to JPI journals through their website. JPI categorically reiterates that authors don't have to pay any fee for submission/publication of manuscripts to JPI journals and the submission is valid only if made through JPI website following the given submission guidelines. Authors are requested not to use any other portal for submission and neither pay any amount whatsoever to anyone for submission. JPI will not be liable for the same.

Mission

To foster and promote a thorough understanding of Indian tax system, tax policy and laws and their implications for domestic and international business practices.

Aims and Scope

Vision is a bi-annual double blind peer-reviewed journal that examines and analyses policy and laws relating to business and taxation in India. The journal invites manuscripts which explores issues related to taxation laws, business laws, tax policy, public finance, national and sub-national fiscal management, federal fiscal transfers and other such issues that have implications for both the theory and practice of taxation. The scope of papers, however, is not limited to the above themes and those papers that contribute to an overall understanding of the functioning of the business and taxation laws and their implications for business are also welcome. The journal intends to serve the interests of academicians, tax professionals, business executives, government functionaries and others interested in taxation in India.

Current Issue: Volume 12, Issue 2 (July - December 2025)

EditorialTable of Contents

Research Papers

Financial Inclusion as a Catalyst for Tax Compliance - Econometric Evidence from Asian Countries

Narasimha Murthy KamakulaDoi: 10.17492/jpi.vision.v12i2.1222501

Pages: 1-18

Published Online: October 25, 2025

Article has been added to the cart. View Cart (0)The Politics of Taxation Reform: A Logit Model of the Centre-State Binary in Value Added Tax and Goods and Services Tax Implementation in India

Isha DasguptaDoi: 10.17492/jpi.vision.v12i2.1222502

Pages: 19-33

Published Online: October 25, 2025

Article has been added to the cart. View Cart (0)Tax Efficiency of Mutual Fund Investments in India: Old vs. New Regime

Prasad Bhat, Shruti Ganpule, Supreet OberoiDoi: 10.17492/jpi.vision.v12i2.1222503

Pages: 34-46

Published Online: October 25, 2025

Article has been added to the cart. View Cart (0)Navigating the Grey Areas: Tax Evasion, Corporate Misreporting, and Enforcement Constraints in Two Developing Nations

Arti Sharma, Rajat KumarDoi: 10.17492/jpi.vision.v12i2.1222504

Pages: 47-59

Published Online: October 25, 2025

Article has been added to the cart. View Cart (0)Revisiting Double Taxation Avoidance Agreements: Normative Analysis Framework for Equitable Taxation

Karanam Kavitha, Roopa H S, Kiran MDoi: 10.17492/jpi.vision.v12i2.1222505

Pages: 60-74

Published Online: October 25, 2025

Article has been added to the cart. View Cart (0)Perception of Tax Payer on Old and New Tax Regime

Preetham D.Doi: 10.17492/jpi.vision.v12i2.1222506

Pages: 75-90

Published Online: November 06, 2025

Article has been added to the cart. View Cart (0)Tax Implications of Startups and Unicorns in India: Current Policy and Future Prospects

Yukti AgarwalDoi: 10.17492/jpi.vision.v12i2.1222507

Pages: 91-110

Published Online: November 21, 2025

Article has been added to the cart. View Cart (0)